how to determine unemployment tax refund

If you are liable for unemployment insurance premiums in Tennessee you will be assigned an eight. For more information about estimated tax payments or additional tax payments visit payment.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

See How Long It Could Take Your 2021 State Tax Refund.

. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your adjusted gross income is less than 150000 in 2020. Enter the income tax refund from Forms 1099-G or similar statement.

The following page will show a Return Transcript Records of Account Transcript Account Transcript and Wage IncomeTranscript for the last. Once you understand the method your state uses to calculate the tax rate you will need to determine how much money to add to your reserve account in order to get to your desired reserve ratio. Select Federal Tax and leave the Customer File Number field empty.

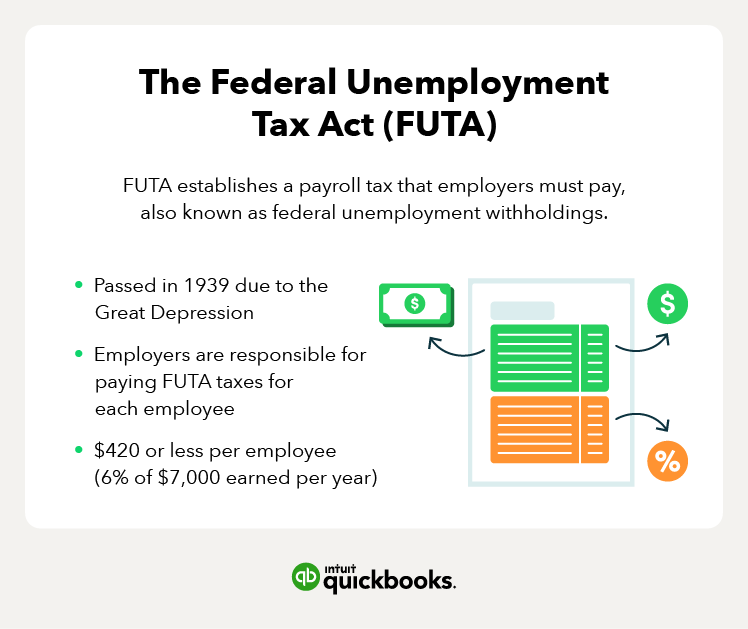

The minimum unemployment tax rate is 05 and the maximum tax rate is 58. Again the rule is that the worked-in state provides the unemployment compensation insurance coverage. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

Submitting this form will determine the status of your liability for unemployment insurance. File Wage Reports Pay Your Unemployment Taxes Online. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their employer. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

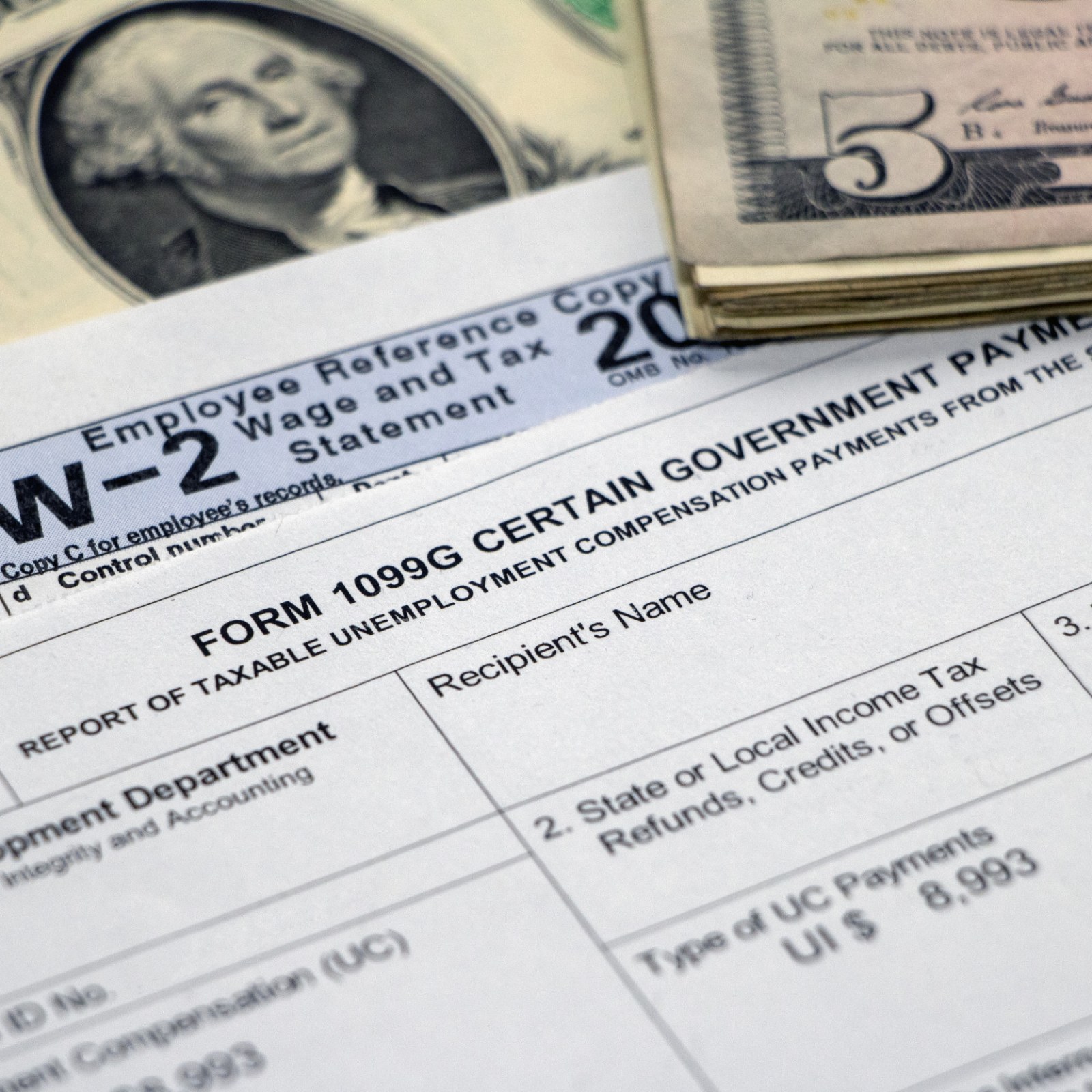

State unemployment insurance benefits. The tax treatment of unemployment benefits you receive depends on the type of program paying the benefits. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. File wage reports pay taxes more at Unemployment Tax Services. If the filing status on your 2017 Form 1040 was married filing separately and your spouse.

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Therefore the employers quarterly wage reports and contributions go to State B. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

In the second scenario the employee lives in State A but works entirely within State B. We make nightly changes to the claimant system MyBenefits Portal from 11 pm 3 am and the system will be temporarily unavailable during this time. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports.

Unemployment compensation insurance coverage. For those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of unemployment compensation and tax. Benefits paid to you by a state or the District.

Enter your total itemized deductions from your 2017 Schedule A line 292. Ad Ask Verified Tax Pros Anything Anytime 247365. The first refunds are expected to be made in May and will continue into the summer.

On the next page click the Get Transcript button. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Viewing your IRS account information.

Since your business has. Unemployment Compensation Subject to Income Tax and Withholding. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. If you received an email asking you to complete a survey and you would like to know more please call 803-737-0368 or visit dewscgovsurvey. Unemployment compensation includes amounts received under the laws of the United States or of a state such as.

But dont enter more than the amount of your state and local income taxes shown on your 2017 Schedule A line 51. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Please check with your employer or.

Unemployment Federal Tax Break. This handy online tax refund calculator provides a. Here youll see a drop-down menu asking the reason you need a transcript.

The 150000 income limit is the same whether you are filing single. Payroll unemployment government benefits and other direct deposit funds are available on effective date of settlement with provider. Using the IRS Wheres My Refund tool.

The state is using the same tax tables as the 2016-2017 taxable year. Ad Learn How Long It Could Take Your 2021 State Tax Refund. Under Section 728 of Tax Relief Unemployment Insurance Reauthorization and Job Creation Act of 2010 TURCA federal tax refunds received after December 31 2009 are not treated as income or resources for a period of 12 months after receipt for purposes of determining eligibility for all federal or federally-assisted programs including Medicaid and the Childrens.

The states SUTA wage base is 7000 per employee. Estimate your tax refund with HR Blocks free income tax calculator. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

Click the Go button. Check For The Latest Updates And Resources Throughout The Tax Season.

1099 G Unemployment Compensation 1099g

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

2022 Federal Payroll Tax Rates Abacus Payroll

Self Employed Taxes How To Get Organized Sweet Paper Trail

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

How To Claim Unemployment Benefits H R Block

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Preparation Checklist Tax Prep Tax Preparation Income Tax Preparation

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How Is Unemployment Taxed Forbes Advisor Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Taxes Will You Owe The Irs Credit Com

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals